Understanding Closing Costs

When buying or selling a home, a substantial expense to consider is the amount you’ll pay for closing costs. Closing costs are the final expenses that need to be paid to close on a real estate transaction.

To help prepare you for the final steps of the homebuying process, this article will break down how much are closing costs in Illinois and what costs you can expect to pay as a buyer and as a seller.

Average Closing Costs

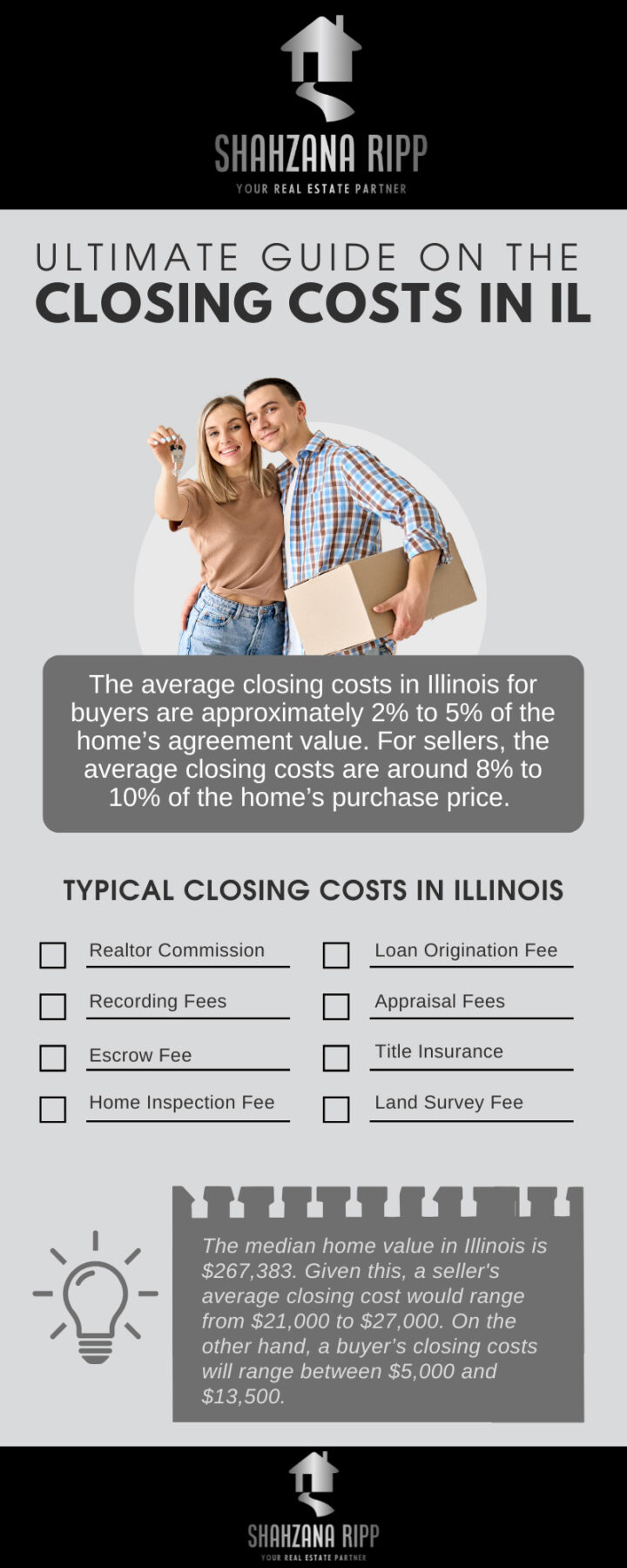

The average Illinois closing costs for buyers are around 2% to 5% of the home’s purchase price. For sellers, the average closing cost is approximately 8% to 10% of the home’s value.

So, how much are closing costs in Illinois for buyers? In Illinois, the median home value is $267,383. Given this, if you are buying a house in the Prairie State, your closing costs may range between $5,000 and $13,500.

On the other hand, if you are selling a house in Illinois, you may have to pay $21,000 to $27,000 in closing costs.

Closing Costs for Home Buyers

-

Loan Origination Fees

Mortgage lenders typically charge buyers a loan origination fee to execute the loan with other relevant documentation and legal formalities. The loan origination fee ranges from 0.5% to 1% of the mortgage loan amount. -

Mortgage Escrow Account

Mortgage lenders reserve a part of the buyer’s monthly mortgage payments in an escrow. This reserve is maintained to pay the property tax and homeowners' insurance premiums on behalf of the buyer. Escrow fees in Illinois can amount to 1% to 2% of the purchase price of the house. -

Title Insurance

A title insurance policy protects the buyer against any type of loss with respect to outstanding taxes, unpaid dues, default in the title, or any violations. Title insurance premiums in Illinois could cost around $550 for the lender’s title insurance and $850 for the owner’s title insurance. -

Appraisal Fees

Appraisal fees are paid to the appraiser who assesses the home value and ensures the buyer gets the best competitive price. The cost for a home appraisal in Illinois varies between $300 and $500.

Closing Costs for Sellers in Illinois

-

Realtor Fee

The seller pays real estate commissions to both the listing agent and the buyer’s agent. The real estate commission in Illinois usually amounts to 5% to 6% of the agreement value. -

Recording Fee

The recording fee is paid by the seller to make the home sale a matter of public record. -

Home Inspection Fee

A home inspection allows sellers to identify any major defects and issues in the property, like plumbing issues, water damage, etc., that must be resolved before the house is listed on the market (pre-inspection) or just before the closing. In Illinois, home inspection usually costs around $400 to $600. -

Escrow Fee

This fee is the remuneration charged by the escrow agent for their services. An escrow agent is an unbiased third party who helps the buyer and the seller complete the real estate transaction. They clear the house for sale, transfer the ownership to the buyer, and the respective funds to the seller.

Who Pays Closing Costs in Illinois?

In Illinois, both the buyer and seller pay certain closing costs at the end of the real estate transaction.

In general, seller closing costs are higher because it is the seller who pays the real estate commissions to both the listing agent and the buyer’s agent. Other fees, like documentation charges and transfer fees are shouldered by the buyer.

Can You Negotiate Closing Costs?

Some closing costs are negotiable, while others are not, such as the taxes charged by the state or local jurisdiction.

Depending upon the current conditions of the real estate market in Illinois, the buyer or the seller can negotiate their share of the closing costs. For instance, in a buyer’s market, the seller may have to bear a portion of the buyer’s closing costs to entice the buyer to purchase the property.

Tips to Reduce Your Closing Costs

Closing costs are not set in stone, and there are a few ways you can lower them. Here are some tips.

-

Use Your Loan Estimate to Comparison Shop

Lenders are required to give you a loan estimate within three days of completing a mortgage application. On page two of this form, you’ll see a section called “Services you can shop for.” The vendors listed here are merely a suggestion. You may opt to ask your lender to offer alternatives or shop around for lower-priced vendors on your own. -

Pay Attention to Lender Fees

You can also benefit from comparing offers from other lenders. Try to get different loan estimate forms from different lenders to compare rates. Many lenders offer incentives to attract borrowers. You can ask if they are willing to offer you a discount or lower loan-related fees, such as origination or underwriting fees. -

Ask for Seller Concession

Your seller can cover some of your portion of the closing costs, often called a seller concession. This would be reflected as “seller credits” on the loan estimate form. -

Consider a No-Closing-Cost Option

Some lenders offer no-closing-cost loan options in exchange for a higher interest rate. However, keep in mind that while this saves you from having to pay the money upfront at the closing, it will cost you more in the long run. -

Look for Grants and Other Assistance

In Illinois, closing cost assistance is available to qualified home buyers through the Illinois Housing Development Authority. The home-buying programs are available to both first-time and repeat homebuyers statewide. Some are interest-free, while others do not have to be paid until you sell your house. -

Schedule the Closing Date at the End of the Month

Setting your closing date at the end of the month reduces the number of days to which the per diem interest is applied before your first mortgage payment is due (usually on the first of each month). To determine the amount you will be saving, multiply your loan amount by your interest rate to get your annual interest expense. Next, divide that figure by 360 to get your daily interest charge (most lenders calculate interest using 360 days, not 365). Multiply that figure by the number of days left in the month plus the first day of the following month. If your loan is funded toward the end of the month, this amount would be much lower than if you were closing in the middle of the month.

Final Thoughts

Closing costs in Illinois can be a significant amount to pay, but this is not set in stone. There are fees and charges that may be negotiated and reduced, and ways to lower your closing costs.

If you need assistance with your real estate transaction, please give me a call at 815-483-7773 or send me an email at shahzanaripp@gmail.com to schedule an appointment.

Frequently Asked Questions

-

How much are closing costs in Illinois for buyers?

The average Illinois closing costs for buyers are around 2% to 5% of the home’s purchase price. -

What do sellers typically pay at closing in Illinois?

For sellers, the average closing cost is approximately 8% to 10% of the home’s value. -

Can I negotiate my closing costs in Illinois?

Some closing costs in Illinois are negotiable, while others are not, such as the taxes charged by the state or local jurisdiction.